Jeff Brown found a way to bring 100X returns with private “Day One” investments. He will be hosting Jeff Brown’s Day One Summit to give you all the details on how these private investments work and how you can get started in this space.

Musk, Cuban, Branson and 7 of the World’s Biggest Banks ALL Piling Into THIS New Tech

Contents

Jeff Brown’s Guide How To Be A Private Investor

So you want to be an angel investor?

I don’t blame you. Investing in private companies — before they reach the public markets — is one of the most lucrative investment strategies in the world.

I say this from personal experience. I’m an active angel investor myself. I’ve invested in more than 260 deals over the years with incredible success.

I’ve invested in ten unicorns (a private company valued at $1 billion). And I’ve also invested in two decacorns (a private company valued at $10 billion.)

And I have seen returns on these investments measured in the thousands of percent.

And then, there are famous examples of private investors and venture capital (VC) firms making a fortune with early-stage companies.

Private investors in Uber, for instance, turned $30,000 into $149 million… $50,000 into $248 million… or even $510,000 into $2.5 billion.

So yes, investing in private deals can be very lucrative.

But it’s a dark art. It involves high-risk decisions every time I make an investment. And angel investors are always dealing with imperfect and incomplete information.

There are no Securities and Exchange Commission (SEC) filings. Oftentimes, the product doesn’t even exist yet. And sometimes, I don’t even have proof that the market exists for the product or service.

Not only can I not be risk-averse, but I actually have to be risk-prone… And not everyone is comfortable with this kind of investing. In fact, very few people are.

But I’ve learned a few things during my many years as an angel investor. So if you’re interested, I can offer a few tips…

— RECOMMENDED —

The World’s First Quadrillion-Dollar Technology? (And $25 Lets You Play It)

LIVE ON CAMERA:The man who called #1 tech stocks of 2016, 2018, 2019 & 2020 based on return…

Reveals the details of a new tech set to grow:

- 113X bigger than the Internet…

- 600X bigger than 5G…

- 2,000X BIGGER than Bitcoin

“This is the biggest investing moment in 400 years – and just $25 gets you in.”

Brown believes the rollout could be days away…

Watch Jeff’s presentation HERE before it’s too late.

Rule One: Understand the Fundamentals

The first rule seems obvious. But you would be surprised how many angels get stuck right away because they can’t assess the value of the technology or the market opportunity.

Does the technology make sense? Is there a clear vertical (i.e., a narrow market where the tech can flourish) for this tech to be deployed in? Is the company doing something entirely new and unique? Or is it just moderately better than what exists in the market today?

For instance, I’m a private investor in Ripple Labs, a blockchain-based payment services company. Without getting into the specifics, this company has radically transformed how cross-border transactions are made by central banks, private banks, and multinational corporations. It’s a brand-new technology, not a small upgrade to an existing system.

Understanding the core technology and the market opportunity is essential before making any investment as an angel investor. Investors who can’t answer these questions correctly end up making bad investment decisions over and over. They lose money. They are gambling rather than making informed investment decisions.

Rule Two: Practice Patience

Investing in private companies is very different from investing in public markets. Investors can purchase shares in public companies one day and then turn around and sell immediately if they want.

With private investments, that’s not an option… Private investments, for the most part, are completely illiquid.

Private investors must wait for what’s known as an “exit” to take money off the table. Typically, an exit means the private company is either acquired or goes public, allowing private investors to sell shares to the public markets.

An angel investor might be sitting on gains as high as 250,000%. But if the company never exits, guess what? All those gains are just on paper.

If you want to be an angel investor, you’re going to have to be patient for these exits. Very patient.

Your first major exit will likely happen within seven to eight years. But private investors may sit on a deal for 10, 15, or even 20 years waiting for an exit.

The longest period that I had to wait for an exit was 15 years. The company finally went public. I made a profit on the investment, but it wasn’t large enough to justify the 15-year wait. Some early-stage investments are like that.

Do you have the emotional fortitude to wait that long for a return? If you want to be an angel investor, you’ll have to cultivate patience and be completely comfortable with the chance that you’ll lose all your money.

— RECOMMENDED —

Why Are Tech Giants Piling $643 Billion Into This New Opportunity?

Why Are Tech Giants Piling $643 Billion Into This New Opportunity?

Top tech firms and hedge funds alike are quietly pouring into what is deemed a “$19 trillion opportunity” – worth enough to BUY the FAANG companies three times over…

Rule Three: Let the Numbers Work for You

Rule three is something I encourage for all investors, even when investing in public companies. You need to build a basket of early-stage companies that all have great investment return potential. In other words, you need to let the numbers work for you.

It may surprise you to know that as many as 75% of VC-backed companies never return money to early investors. What that implies is that most investments made by venture capitalists actually fail.

An important rule to being successful as a private investor is to cultivate a large basket of private deals and let the statistics work for you.

Many of the investments will fail completely. Some might return your money with a modest profit. And a small percentage can go on to deliver life-changing returns. It’s these “jackpot” investments that make up for all your losses and then some.

That’s why the basket is so important. While I may have opinions about which companies are going to deliver extraordinary returns, there is really no way to tell which ones will.

As I said, I estimate I’m sitting on a return as high as 250x. When this company has an exit, my return will more than make up for the small number of losses I’ve had in the past.

As a starting point, a portfolio should have a minimum of 30 companies. A more robust portfolio would aim to have 100. The more quality private investments you make, the better your chances.

And investing over an extended period will always work to an investor’s advantage. For example, it is not prudent to make all your early stage investments in just one year and then wait for them to mature over the five to 10 years that follow.

Technology is advancing so quickly, it is important to get exposure to new companies that are working with the most advanced technology every year.

We can think of our investments in “cohorts” made each year over a span of years.

— RECOMMENDED —

His Crypto Picks Humiliate Stock Gains

(And You Can Get His New Pick Free!)

If you believe a 10-bagger – the rare investment that delivers 1,000% returns – is impressive, then check this out….

151,323%.

That is an actual gain from just one of Teeka Tiwari’s best crypto picks.

And you can get his next crypto pick for FREE!

Past performance is no guarantee of future results.

But a $100 investment into just this one pick would be worth over $151,000 today.

Click here for Teeka’s next top free crypto pick… no strings attached…

Venture Capital-Like Returns for Everyday Investors – Are they Possible?

Now, here’s the bad news…

Unless you are well-connected and have a very large amount of capital to deploy, breaking into the private investing space has been difficult… even impossible for some.

This has been one of the most unfair dynamics in the investment world over the past decade.

Bleeding-edge technology companies with the potential to be “the next Amazon” have been mostly locked away from everyday investors. They are intentionally being kept private for extended periods of time.

This allows well-connected venture capitalists and private equity firms to capture the majority of the upside for themselves. Once the company finally goes public, there is very little upside left for everyone else.

That’s not fair.

So I decided to do something about it.

— RECOMMENDED —

The White House… Congress… and Big Tech are all in a panic

This has happened quietly…

The White House is “racing” to respond. Congress is rushing billions of dollars out the door to stem the bleeding. Big Tech is in a predicament.

As one tech analyst puts it, “Everyone is in crisis, and it is getting worse.” Elon Musk says he has “Never seen anything like it.”

While Big Tech and the US government are in a panic…

A select group of Americans preparing for the trade of a lifetime.

Because they know the last time anything close to this happened, investors who acted fast snatched gains as high as 2,900% in one year… 3,700%… and even over 9,000%.

Jeff Brown’s Day One Summit Overview

For the past six years, I’ve been searching for ways to bring these kinds of life-changing investments to my readers. And I’ve finally found a way.

And I am going to bring these types of recommendations to my readers… chances to achieve 100X returns… with private “Day One” investments.

I understand you might be skeptical. But I can prove that generational wealth is now possible thanks to quality private investments.

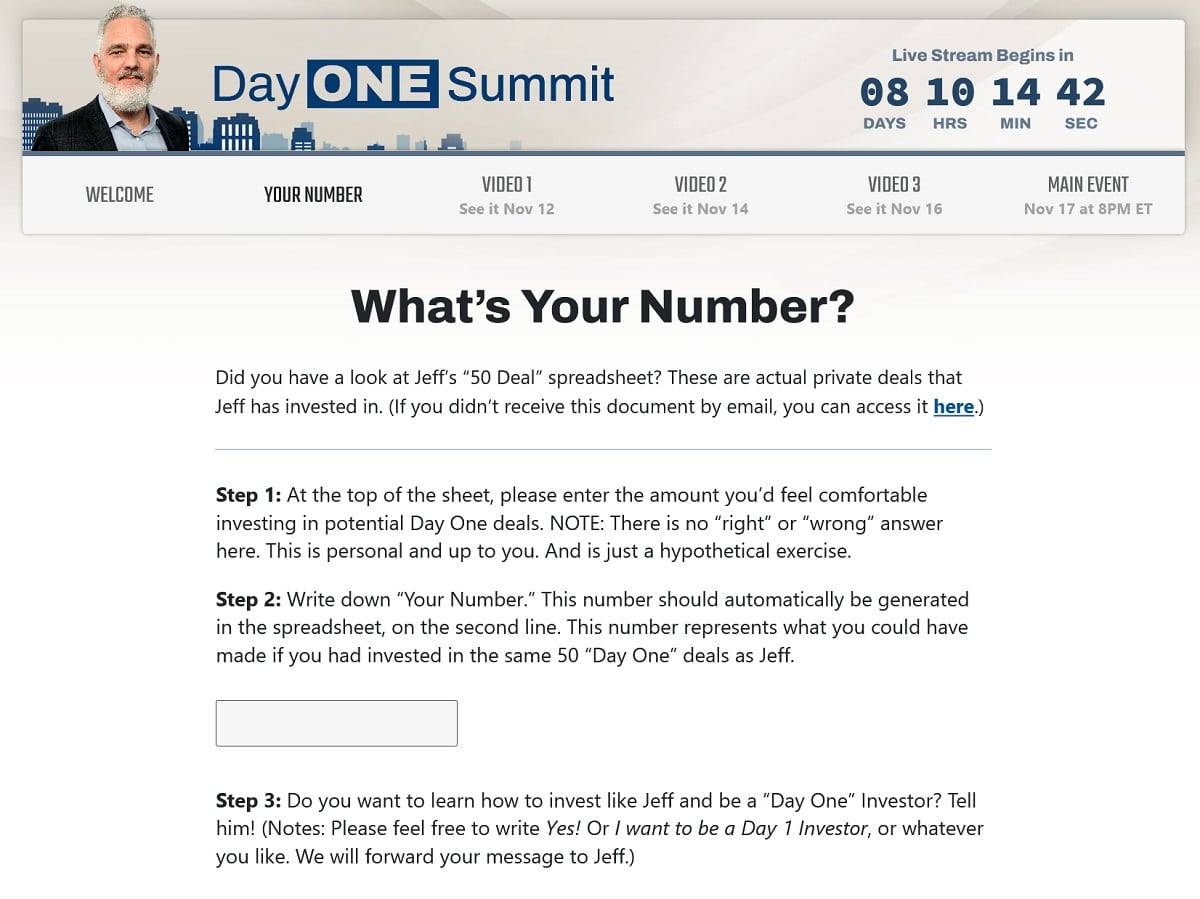

To get the full story, I encourage you to tune in on Wednesday, November 17, at 8 p.m. ET for my Day One Summit.

I’ll be hosting this special presentation to give you all the details of what changed… how these private investments work… and how you can get started in this space. It’s something I don’t want anyone to miss out on.