Farmageddon is an exclusive financial forecast from Andrew Zatlin, Founder & Chief Analyst of Moneyball’s Sector Alpha Report. Considering the inflation and food shortages, Andrew has a FREE recommendation to potentially profit from food crisis, using one simple investment.

What’s Andrew Zatlin’s FREE recommendation – Click here for details

Contents

- 1 What’s Andrew Zatlin’s Farmageddon?

- 2 Who is Andrew Zatlin?

- 3 Zatlin’s steps to protect his family and assets

- 4 Andrew Zatlin’s Farmagedon Flashpoints

- 5 Zatlin’s Step by Step Emergency Plan

- 6 What Is Moneyball’s Sector Alpha Report?

- 7 What is included Andrew Zatlin Moneyball’s Sector Alpha Report subscription?

- 8 How much does Moneyball’s Sector Alpha Report cost?

- 9 Moneyball’s Sector Alpha Report Refund Policy

- 10 Moneyball’s Sector Alpha Report: Is It Worth To Try?

What’s Andrew Zatlin’s Farmageddon?

Now you are probably wondering what Farmageddon is. Andrew Zatlin came up with this word to describe the problems that farmers are currently facing. We are talking about higher costs and shortages that are expected to wipe out harvests across the planet.

The result is that the cost of food will likely skyrocket in the next 12 months to levels we’ve never seen before. Yet Farmageddon will spiral into something much worse.

Zatlin is anticipating massive food shortages that will lead to bread lines and bread riots.

The purpose of his letter is not to try to scare his readers. In fact, he wants to share ideas what you can do to protect your money and your lifestyle.

Who is Andrew Zatlin?

Andrew was recently ranked #1 for Jobs Forecasting by Bloomberg. He was ahead of many analysts at major Wall Street firms like JP Morgan and Bank of America.

He runs an investment research firm, MoneyBall Economics. His research has been used by more than 20 hedge funds to make investment decisions.

Zatlin’s steps to protect his family and assets

Surely the Federal government will take steps to protect the regular people. But are you confident it will figure it all out? I’m not.

Let’s see what steps Zatlin is taking to protect his family and his assets, even his exact steps he is taking to profit from this situation.

Because in every crisis in human’s history, there have been unique opportunities to profit. Whenever we see a repeat of history in world events, we often see a repeat in history in the markets.

Andrew Zatlin makes a point with few examples showing when shortages went up in the recent years, so did certain investments – commodities, stocks, ETFs and others.

Let’s check out the three specific flashpoints he is currently seeing.

— RECOMMENDED —

A New Way To See Which Stocks Could Double Your Money

We want to give you FREE access to the Power Gauge system ($5,000 value).

Claim FREE access to The Power Gauge Here

Andrew Zatlin’s Farmagedon Flashpoints

#1 Farmagedon Flashpoint: The war in Ukraine

Ukraine and Russia are Europe’s, Africa’s, and Asia’s “breadbaskets.” Russia and Ukraine contribute for over 30% of all world wheat exports in a regular year.

With the war going around, one-third of Ukraine’s farmlands may not be harvested or cultivated this year.

With the global sanctions, Russia won’t be able to export wheat.

According to the Financial Post, the war has blocked more than a quarter of world wheat commerce, a fifth of global corn traffic, and 12% of global calorie trade.

Because of the food shortages in Russia and Ukraine, American farmers will have to expand their production.

Consider the company American Vanguard. Insecticides, fungicides, and herbicides are among the products it produces for farmers. This company’s shares increased by 451 percent in the years following the 2011 food crisis. That’s roughly a 5X return!

Of course, the trick is to spot these chances before food costs skyrocket…

Opportunities can be found in commodities, stocks, or both. Occasionally, in more unconventional investments.

The good news is that we still have time to take advantage, and potentially profit from Farmageddon.

#2 Farmagedon Flashpoint: The World is Running Out of Fertilizer

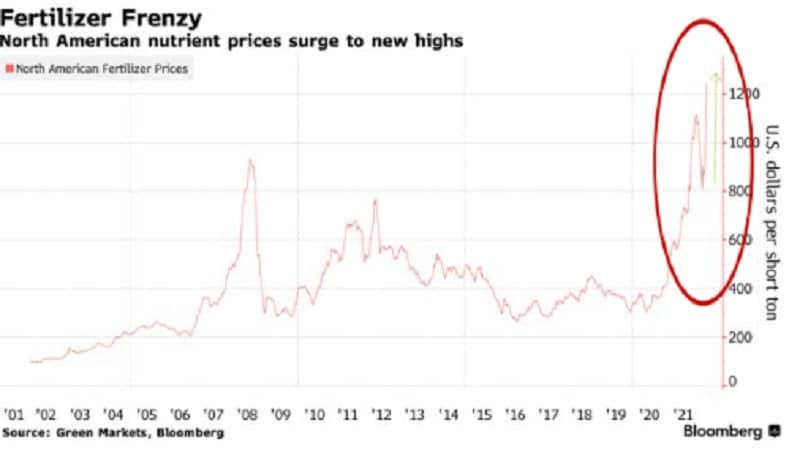

Higher fertilizer costs are just one of many factors that explain the food shortages and record high food prices. Keep in mind that Russia is the world’s largest fertilizer exporter. Some fertilizer prices have risen by as much as 300 percent since this time last year.

It appears that record-high fertilizer costs — combined with fewer crops produced — will drive food prices much higher than they are presently…

However, they will almost certainly cause the prices of certain investment possibilities to surge…

Smart investors who know where to seek will have the opportunity to build massive fortune…

Consider the company CF Industries Holdings, for example…

It produces the raw materials for fertilizer.

As you can expect, this company’s product was in high demand during a global food crisis.

In fact, during the 2011 food crisis, CF Industries reported a 429 percent increase in its stock…

As food costs rise even higher as a result of Farmageddon, Zatlin expects a slew of new opportunities to emerge.

#3 Farmagedon Flashpoint: A Perfect Storm of Bad Weather, Shortages & Disease!

It is going to be a bad harvest this year in a lot of other places. What are the other issues?

- Bird Flu – The bird flu pandemic in the United States continues to spread, and as a result, the price of eggs has more than doubled in recent weeks. We will also see shortages of poultry.

- Bad Weather – According to the National Weather Service, drought conditions will persist or worsen in over half of the continental United States in the next months. Winter flooding has damaged China’s crops. Keep in mind that China is the world’s biggest wheat consumer.

- Higher energy prices – you already felt the pain at the pump from high gas prices. Think about what higher prices do for the farmers. Tractors run on fuel. Trucks that transport fertilizers and crops also rely on fuel. Rising fuel prices will result in higher food prices.

- More supply shortages – the same chip shortage in automobiles is hitting also farm equipment. Farmers are also facing labor shortage, like many other sectors of U.S. economy.

Titan Machinery was a corporation that existed during the 2011 food crisis.

It owns and operates retail locations that offer agricultural equipment such as tractors.

Farmers needed more new tractors in 2011 because of the high demand for food prices.

Titan’s stock increased by 140 percent as a result.

Can you image being able to find possibilities like these from Farmageddon today?

I sincerely hope so. Because below I would like to tell you Zatlin’s recommendations.

Zatlin’s Step by Step Emergency Plan

Step 1: Stock up on food right now.

Zatlin’s advice is to stockpile with food and water for at least 6 months. This will keep you and your family protected as Farmageddon plays out. Stocking up ahead of time allows you to keep more money in your pocket while also providing a solid hedge against rising food prices.

Step 2: Make this investment ASAP

The investment is an ETF… an exchange traded fund. This means it invests in a basket of stocks and securities, giving you broad exposure to a certain sector. It is called Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF. It is a long name, but the ticker is enough: PDBC

PDBC provides extensive exposure to the world’s most heavily traded commodities, including those that will see price spikes as a result of Farmageddon.

You can buy PDBC using your normal brokerage account.

To make it clear – don’t expect to get rich with this play. Zatlin is expecting this play to grow enough to help you offset the rising grocery bills in the future.

Step 3: Zatlin’s top investment picks. Invest Directly into the Farmageddon wealth boom.

Step #3 is designed to assist you if you’re seeking a way to get significantly wealthier while this all unfolds.

Zatlin has found a way to potentially make money. You access full information in a special investing dossier, titled “Formageddon: Six Ways to Get Rich from The Global Food Crisis”.

Inside are instructions which opportunities to get into, and at what prices.

With Farmageddon, Zatlin is seeing a lot of potential profit opportunities in the markets, including:

- Commodity futures trading

- Commodity options

- Stocks

- Stock options

- ETFs

For instance, inside his investing dossier you will read about an “under-the-radar” small-cap pesticide manufacturer with massive explosive upside potential. With this little business, gains of 200 percent, 300 percent, or even close to 1,000 percent may be feasible.

You will learn about a wonderful “backdoor” play that you may use instead of buying John Deere. Deere & Firm (John Deere’s parent company) has seen its stock rise 215 percent in the last two years…

You can take a look at his research in his Farmageddon dossier at no risk or obligation trial subscription of his monthly report called Moneyball’s Sector Alpha Report.

What Is Moneyball’s Sector Alpha Report?

This service is launching to help people like you and me a chance to make money in the stock market. This is where Zatlin will give clear instructions on what to buy, and what to sell. All actions are based on his unique methods.

Sector Alpha is a monthly report that comes out around the 15th of the month. Inside each issue you will find his “Moneyball Portfolio”. This is a portfolio that will help you to take advantage of the four biggest sector rotations of the month. All derived from his patent-pending “alternative” database.

Each month, you simply sell the previous month’s four ETFs, and rotate into the new month’s sectors that Zatlin will give you. That’s it.

Anytime he finds new “special situation”, he will send you a new special situation report packed with stock market moves to make.

What is included Andrew Zatlin Moneyball’s Sector Alpha Report subscription?

The moment you take the risk-free offer, you will receive the following bonus reports:

- 12 monthly issues of Sector Alpha report

- Instant download of special investment dossier “Formageddon: Six Ways to Get Rich from The Global Food Crisis”.

- E-mail updates whenever news breaks that impacts his Farmageddon thesis

- Special Bonus Report #1: How to Get Rich From The Coming “ITL Boom”. Inside you will find out what the “ITL Boom” is, and which investments are perfectly positioned to potentially make money. It includes six specific stock recommendations you can simply buy from your brokerage account.

- Special Bonus Report #2: The Moneyball Trader’s Playbook that includes all the tools you’ll ever need to invest in the economic trends. Zatlin reveals the most valuable strategies he has ever developed. Inside you will learn:

- How to predict which sectors are falling in or out of favor in the market?

- How to catch BIG earnings surprises every quarter?

- The “crystal ball” for the stock market. Zaltin first discovered it as a student in Japan.

- The “secret formula” behind over 800 companies that can tip you off to BIG moves in their stock prices.

- How to use sex, drugs, and gambling in a positive way to be a better investor.

- The secret Zaltin learned from Atlantic City blackjack dealer that helped him to avoid big market crashes.

How much does Moneyball’s Sector Alpha Report cost?

Standart price for 12-months of this service is $299 per year. With current promotion you can choose from three discounted plans:

- Very Best Offer is just $149 for 12-months digital subscription + extra bonus reports+premium customer service. Renews at $149 every year thereafter.

- Premium offer is $149 for a 12-month digital subscription + bonus reports. Renews at $149 every year thereafter.

- Basic offer is $99 for a 12-month digital subscription. Renews at $99 every year thereafter.

Moneyball’s Sector Alpha Report Refund Policy

With current promotion his standard 15-day satisfaction guarantee is doubled to 30-days. This means you can get a full refund in the first 30 days for any reason. Plus, you can keep his special dossier about Farmageddon and all other reports.

Moneyball’s Sector Alpha Report: Is It Worth To Try?

If you think this service is worth to try, don’t wait because this special trial offer could expire at any time.

Get Andrew Zatlin Moneyball’s Sector Alpha Report Here – Best Offer + Bonuses