Whitney Tilson just put the finishing touches on a brand-new presentation about one stock in particular that could help you beat the current surge in inflation.

Why June 10 Will Deliver a Major Inflation Shock

By Whitney Tilson

I know a lot of folks out there are worried about inflation…

And I can’t blame them. Inflation recently hit a 40-year high. We’re paying more for everything: gas, food, entertainment, prescription drugs, you name it… Prices of just about everything are going up.

USA Today reports that “inflation is ravaging seniors’ retirement income.” And NPR says “inflation has many retirees worried about outliving their savings.”

In fact, I believe we’re just days away from a major inflation shock, which is coming as soon as June 10.

And everyone should prepare for what’s about to happen, because I believe this will be a major inflation shock that will catch most people by surprise.

That’s why I’m writing to you today… I want to give everyone reading this the chance to make the right move.

Because doing so could be the difference between losing a lot of money and falling behind on your retirement plans or walking away from this coming inflation shock with healthy gains. Let me explain…

— RECOMMENDED —

Make this $4 move, beat inflation

Make this $4 move, beat inflation

Savvy Americans have found the perfect way to beat inflation. Anybody over 18 can do it.

And it’s 100% legal.

You see, these headlines aren’t telling you the entire story…

And if you just buy commodities or cryptocurrencies to protect yourself against inflation, I believe you’ll be making a critical mistake.

But before I explain what’s happening on June 10, and why I believe this will trigger an inflation shock that will have huge implications for the entire market, I’d like to give you a bit of background.

I’ve built my reputation over the past two-plus decades off of predicting the biggest market trends, way before anyone else.

Regular readers know CNBC nicknamed me “The Prophet” for my accurate string of market calls…

While the nickname embarrasses me, I earned it for good reason.

For example, in 2000, I warned that tech stock valuations were simply unsustainable…

A month later, the dot-com bubble finally burst, wiping trillions of dollars out of everyday Americans’ hard-earned retirement accounts.

Several years later, in early 2008, former Federal Reserve Chairman Ben Bernanke came out and said, “The Fed is not forecasting a recession.”

He was the top economist in the country. He said, “The U.S. economy remains extraordinarily resilient.”

Bernanke wasn’t alone. In fact, most economists back then were saying a recession was unlikely.

But I knew they were wrong. So in December 2008, I went on 60 Minutes and said…

We had the greatest asset bubble in history, and now that bubble is bursting. The single biggest piece of the bubble is the U.S mortgage market, and we are probably about halfway through the unwinding and bursting of that bubble.

I knew things were about to get a lot worse. I even predicted the bankruptcy of Lehman Brothers. And we all know what happened next…

Lehman Brothers indeed went bankrupt, and suddenly everyone went into panic mode. Stocks quickly collapsed.

Millions of Americans watched their retirements evaporate right before their eyes. Many are still dealing with the consequences to this day.

But had you listened to my contrarian market call, you could have avoided the bloodbath.

— RECOMMENDED —

URGENT INFLATION REPORT

Americans Over 60 Must Do THIS Now!

Thanks to lousy fiscal policies, the U.S. is experiencing rapid price increases unlike almost anything in the last 39 years.

That’s why it’s so important to ACT NOW to preserve your retirement wealth (especially if you’re over 60).

This report is 100% FREE! Download it here!

It takes a lot of courage to go against the crowd, but that’s the only way to make big money in the markets…

For example, look what happened on March 23, 2020, the day stocks bottomed during the COVID crash. News outlets around the world were predicting the worst economic crisis since the Great Depression.

But that very day, I told readers of my free e-letter…

We’ve come to the firm conclusion that this is the absolute best time to be an investor in more than a decade. To borrow a phrase from one of my friends, “we’re trembling with greed” right now.

My colleague Enrique Abeyta and I recommended a basket of 10 stocks we thought would rally hard. And boy, did they.

One of our recommendations, casino operator Penn National Gaming (PENN), rose as much as 837%… enough to turn every $5,000 into almost $47,000. Another, beaten-down clothing retailer Capri Holdings (CPRI), rose 467%, enough to turn every $5,000 into more than $28,000.

Even our “safe” recommendations of blue-chip stocks like Warren Buffett’s Berkshire Hathaway (BRK-B) and e-commerce juggernaut Amazon (AMZN) would have almost doubled your money.

Again, those gains were only available for people who followed my contrarian advice at the time.

Today, I’m coming to you with a similarly contrarian message. It’s one of the biggest reasons I’m bullish on stocks right now.

— RECOMMENDED —

Be Warned: A Specific Type of Market CRASH Is Coming Soon

Be Warned: A Specific Type of Market CRASH Is Coming Soon

It’s actually much bigger and more important than what happens to the NASDAQ or S&P. Yet some of the world’s best investors are practically drooling in anticipation. Because this crash will create a slew of 100%-plus opportunities… backed by legal protections that stocks can only dream of. A top analyst tracking the story believes this could happen within months – and you must prepare now.

Get the full story here right away.

My extremely contrarian opinion today is that I believe inflation has peaked and will end the year at around 4%…

If I’m right, it will have huge implications for the market because it will surprise just about everyone.

Trust me, I know that it’s hard to be a contrarian. It’s much easier to just join the consensus and follow what everyone else is saying.

But to make real money in the markets, you have to be a contrarian.

I think we’ll start to see this transformation come as soon as June 10, which is when the government is set to release the latest inflation numbers for May.

To combat inflation, the Federal Reserve has been raising interest rates, which is causing investors to panic…

There’s a widely held notion that higher rates cause market crashes.

But if you try to find data showing a correlation between rising rates and falling markets, you might be surprised by the results.

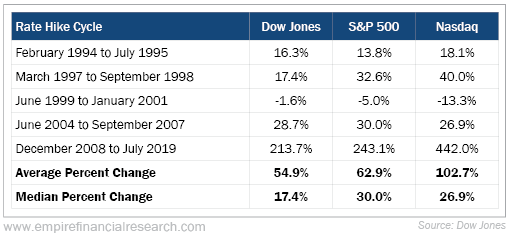

Dow Jones market data analyzed the five most recent rate hike cycles – like the one we’re in today – and found that the market only fell during one… and that was in the middle of the dot-com bubble. Take a look…

As you can see, in the four other instances, the S&P 500, Dow Jones, and Nasdaq were all up double- or triple-digits.

The numbers don’t lie: Just because the Fed is raising rates doesn’t mean the market will crash.

— RECOMMENDED —

How to Boost Your Income by AT LEAST $36,000 Over the Next 12 Months

How to Boost Your Income by AT LEAST $36,000 Over the Next 12 Months

You don’t need to find a second job, discover a once-in-a-lifetime value stock, or speculate with cryptocurrencies. Last year, this 94% accurate, crisis-proof strategy handed some Americans the opportunity to make an extra $27,411. And early returns show 2022 could be even better.

Complete details are right here.

Once inflation started to increase, we saw a lot of money flowing out of high-growth tech stocks and into blue-chip value stocks…

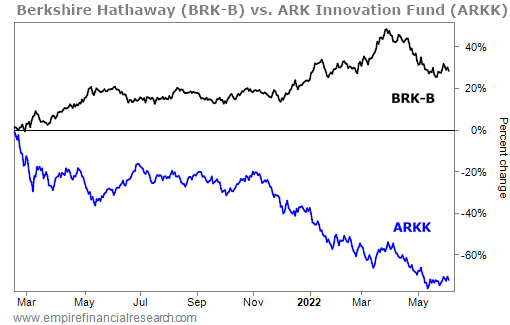

Take a look at this next chart, which plots Buffett’s Berkshire Hathaway against tech investor Cathie Wood’s ARK Innovation Fund (ARKK).

ARKK is an exchange-traded fund that holds popular growth stocks like electric car maker Tesla (TSLA), video-conferencing platform Zoom Video Communications (ZM), telehealth firm Teladoc (TDOC), and streaming company Roku (ROKU).

Starting in March of last year, the market started to anticipate the high inflation we’re seeing today, so investors started to move their money out of these high-flying tech stocks.

I warned my readers in February and told them to get out before the bloodbath started.

Sure enough, tech stocks already crashed hard, just like I predicted. As you can see, over the past 15 or so months, Berkshire has outperformed ARKK shares by more than 100 percentage points…

Most of that money went into low-risk, blue-chip value stocks like Berkshire, which owns big stakes in “boring” businesses like insurance and utilities, as well as Apple (AAPL), Bank of America (BAC), Chevron (CVX), Coca-Cola (KO), and American Express (AXP).

If this all happened because inflation started to go up, guess what’s going to happen once inflation starts to come down?

I expect we’ll see a ton of money flowing back into high-quality tech stocks that have crashed.

Look, a lot of people are predicting a crash. But they’re missing the fact that we already had one.

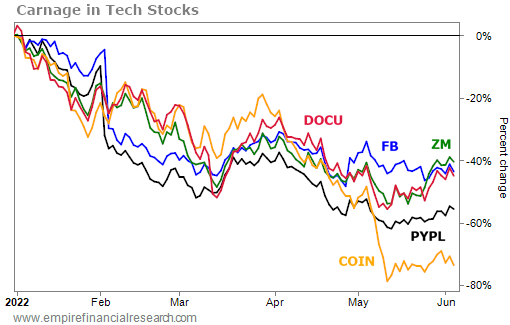

Many tech stocks have gotten absolutely destroyed just this year alone. Take a look…

I believe tech is where investors will find some of the best opportunities going forward.

If I’m right that inflation has peaked, then stocks are likely to soar in the coming months…

That’s why I just put the finishing touches on a brand-new presentation about one stock in particular that could help you beat the current surge in inflation, even if I’m wrong about the shock that’s likely to come on June 10.

This could also help you overcome rising interest rates and even survive the unprecedented market volatility that’s hitting investors so hard right now.

You could load up on shares today without breaking the bank… and in a short time, you could be sitting on the payday of a lifetime.