Access Doc Eifrig’s Retirement Trader at the Lowest Price Ever – PLUS: A Second Year FREE

Editor’s note: Many investors play the wrong game with the stock market…

They bank on finding stocks that go up. And that’s hard to do… You can get everything right in your analysis about a company, and yet, the stock goes down when you buy it.

But with options, you can play a better game. You don’t need to only find stocks that go up… You can make money on stocks that rise, stay flat, or even those that fall a little bit.

In today’s essay, our colleague and Retirement Trader editor Dr. David “Doc” Eifrig explains why he loves using options. And more important, he shows a real-life example of how this strategy pays off…

By Dr. David Eifrig, editor, Retirement Trader

Now, it’s time to get to the goods…

In yesterday’s essay, I shared the reasons why I love options. And as I’ve said, I think you’ll love options, too… if you just take some time to get to know them.

Even though I know most investors won’t give options a fair chance – or even worse, they’ll use them incorrectly – I’ve been running Retirement Trader for more than 10 years now.

It’s a labor of love…

I publish Retirement Trader so I can show the small number of subscribers who are willing to take charge of their finances how to earn consistent, low-risk income from the stock market.

Yesterday, I explained in broad strokes how options allow us to turn steady, dependable stocks into income-producing machines. On any given stock, we can collect hundreds – or even thousands – of dollars in income, depending on how much capital you use.

I also talked about how my options strategy changes the way we look at stocks. Rather than searching for the next “hot” stock to make a quick profit, we can turn to boring, flat, forgotten stocks time and time again… and profit even when they don’t move much.

And of course, I argued that you owe it to yourself to take a little time to learn how this all works. But admittedly, I haven’t really showed you how it all works yet. I’ll do that today…

You see, we sell options to speculators and hedgers, turning their money into our own.

More specifically, we sell put options.

— RECOMMENDED —

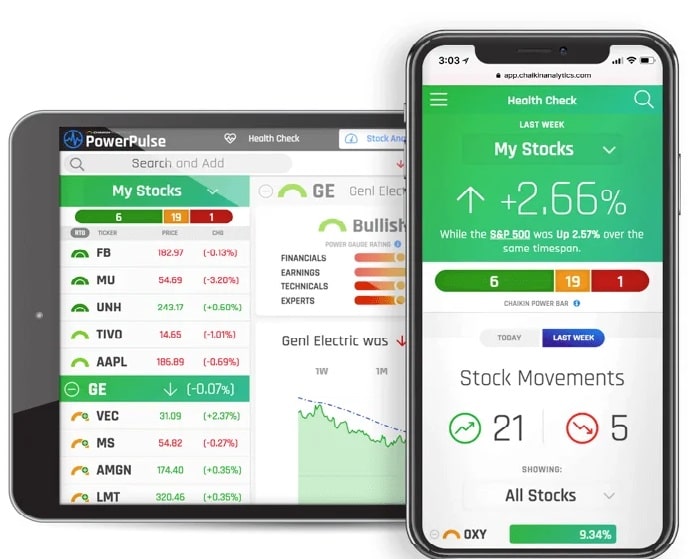

A New Way To See Which Stocks Could Double Your Money

We want to give you FREE access to the Power Gauge system ($5,000 value).

Claim FREE access to The Power Gauge Here

That means we enter a contract that obligates us to buy shares of a stock at a given price in the future. And for entering that agreement, the put buyer pays us money up front.

You can think of put buyers as people who want to either hedge the downside of shares that they already own or want to speculate that a specific stock will fall a certain amount in a particular time frame.

In either case, it usually doesn’t happen. Hedges are bought for safety… but ideally, you don’t need them. And speculators tend to lose money when things don’t go their way.

As put sellers, we take the opposite side of those bets and collect the money up front. In the worst-case scenario, we end up owning shares of a company we like in the first place.

Let me show you exactly how it all works for Retirement Trader subscribers with a quick example…

— RECOMMENDED —

A Low-Risk Shot at a ’10 Bagger’ (Royalties)?

A Low-Risk Shot at a ’10 Bagger’ (Royalties)?

The senior analyst behind 24 different triple-digit winning recommendations (as high as 849%) calls this the single best “buy” opportunity of his lifetime. It could triple quickly… and return 1,500% or more long term. And it’s the cornerstone of his dead-simple strategy for BEATING today’s sky-high inflation.

In late March, my research team and I liked Warren Buffett’s holding company Berkshire Hathaway (BRK-B). At the time, Berkshire’s stock was down 20% from its February high, and the company was sitting on a massive cash pile of $128 billion.

We knew that Berkshire’s incredible cash cushion made it a safe bet. That’s because a mountain of cash is one of the most important things to have during a recession… It provides much-needed flexibility for a management team.

We also thought that Buffett could put that cash to use and buy up another company… sending the stock much higher as a result.

The stock traded for roughly $183 in late March… And based on Berkshire’s fundamentals, we were confident that the stock would be higher in the near future.

So in Retirement Trader, we recommended selling, to open, the Berkshire $150 puts due in May.

By making the trade, you agreed that if Berkshire traded for less than $150 per share come May 15 (the so-called “option-expiration day”), you would buy 100 shares for $150 each.

To enter that agreement, you would’ve gotten paid $385 up front. That cash would’ve hit your brokerage account instantly. It was yours to keep.

Two things could’ve happened from there…

As long as Berkshire stayed above $150 per share through May 15 (which it did), you would earn the $385 free and clear.

On the other hand, if Berkshire’s share price had dropped below $150 through May 15, you would have to buy 100 shares for $150 (at a total cost of $15,000). But you would still keep the $385 upfront payment.

Think about that for a second…

You got paid $385, and the worst thing that could have happened was that you would need to buy 100 Berkshire shares for $150 per share. Remember, Berkshire was trading at $183 at the time… You got paid $385 for agreeing to potentially buy shares of one of the best companies in the world at an 18% discount.

Essentially, you were in a no-lose situation.

And sure enough, as we anticipated, Berkshire traded for much more than $150 per share by the May 15 option-expiration day.

If you made the trade, you got to keep your full cash payment with no further obligation.

Now, $385 may not get your engine revving. I get it. But there’s an advantage to this type of trade that makes the income payment even more attractive…

It only takes two months.

For mathematical reasons, selling options that expire in two months offers the greatest returns. In Retirement Trader, all our trades are designed to last about that long.

With that in mind, we can collect $385 from the Berkshire trade. Then, two months later, we can collect another $385. Two months after that, another $385… and so on.

Over the course of a year, assuming all things remained equal, you could make the same trade six times and earn $2,310. In terms of risk, you would need the capital to buy 100 shares of Berkshire in case its share price dipped below the strike price. That was the $15,000.

Collecting $2,310 on $15,000 would equal a total return of nearly 16% a year… even if Berkshire stayed flat or fell a little. Do you have a savings account, bond, or other trade that can return that much?

Of course, we don’t make this exact Berkshire trade every two months. And at the time, we were able to take advantage of extreme levels of volatility in the market.

But in Retirement Trader, we always have a stream of potential trades to make. Maybe we’ll move on to Coca-Cola (KO) next month… or Starbucks (SBUX) or CVS Health (CVS).

Remember from yesterday’s essay, the great thing about using options to make money is that it opens up opportunities across dozens of safe stocks.

That’s the trade we make, again and again, without any hidden secrets or wild claims.

We sell an option and agree to buy a stock if we have to… If the stock rises or stays flat, we keep our income. If the stock falls, we have to buy it. But by doing it this way, we actually incur less risk than normal shareholders because the option income lowers our cost basis.

If you thought options were confusing before this educational article, I hope you’re starting to see that it’s a straightforward proposition. And if you thought options were risky before this weekend’s series, again, please consider our track record…

Since starting Retirement Trader nearly 10 years ago, we’ve earned profits on 93% of our recommendations. That’s 490 winning positions out of 528 total recommendations.

With that, my research team and I will now retire to our spreadsheets and Bloomberg terminals to continue building our steady stream of option trades. After all, it takes a good deal of work to win 93% of the time.

I’ll stop singing all the praises of options in the Digest now. But please, don’t let this be the last time you ever think about options. They’re likely just what you’re looking for.

— RECOMMENDED —

Is This THE END of the Technology Bull Market?

Is This THE END of the Technology Bull Market?

Stocks are bouncing back after a rough week in the markets. But with inflation at 40-year highs and geopolitical shock escalating, chief technology analyst Matt McCall weighs in and shares his No. 1 recommendation for your money today.

Editor’s note: Many folks suffered a significant hit to their portfolios when the COVID-19 pandemic struck in March. But some folks were able to increase their investment income by 400% or more… thanks to the 93% accurate, crash-proof strategy that Doc has used for decades. To learn all about it – and how it could help you potentially add thousands of dollars to your bottom line every month – check out his brand-new presentation right here.