Contents

Jason Bond Monday Movers Results – The #1 trade members keep messaging me about

Over the weekend there was one ticker especially made noise on Wall Street.

That ticker? DGLY

As a supplier of law enforcement technology, their share price exploded over the weekend as the unfortunate events across the county unfolded.

Well on Friday (5/29/2020), I sent out an email to members of my premier Monday Movers service with my analysis:

The Result On Monday (6/2/2020)?

CHA-CHING!

If timed perfectly… traders could have made as much as 236.14% max profit!

Of course – it’s difficult to time one day’s low and another day’s high perfectly… but just look at what some of the results my members reported back to me with*:

These are JUST A FEW of the many Monday Movers traders who wrote in with their weekend success stories yesterday.

I really wish you could have been one of these traders [first name]… but frankly… I did my part by inviting you on Friday (right before I sent this watchlist out).

You can’t say I didn’t give you a chance.

But here is this thing with Monday Movers… every Friday I send out a detailed list + my analysis of stocks that I predict will gap up over the weekend for Monday profits.

AND THE NEXT WATCH LIST IS RELEASED ON FRIDAY!

Since you missed out on my last Monday Movers, for a limited-time i’m going to honor my $97 / year deal that I offered you on Friday.

You can receive 52 of my next Monday Mover’s Weekend Watchlists every Friday for less than $1.87 per week!!!

Seriously… Don’t miss out on Friday’s watchlist again! Join before I start charging it’s normal price of $799 again

CLICK HERE TO RECEIVE THE LIST

Once you join you’ll immediately be put on the list to receive this Friday’s watchlist.

Jason Bond Preparations For The Trading Week

Tomorrow is the start of the last month of the first half of 2020… and I believe there’s going to be a lot of action.

With futures set to open in just a few hours, I’m going to take a look at the price action and see what’s up.

For me personally, a bulk of my trading preparation — when it comes to uncovering hot momentum stocks — starts on Monday mornings.

I know what you’re thinking, “Jason, how are you possibly able to figure out what stocks to trade just hours before the opening bell?”

Well, for me it’s pretty simple.

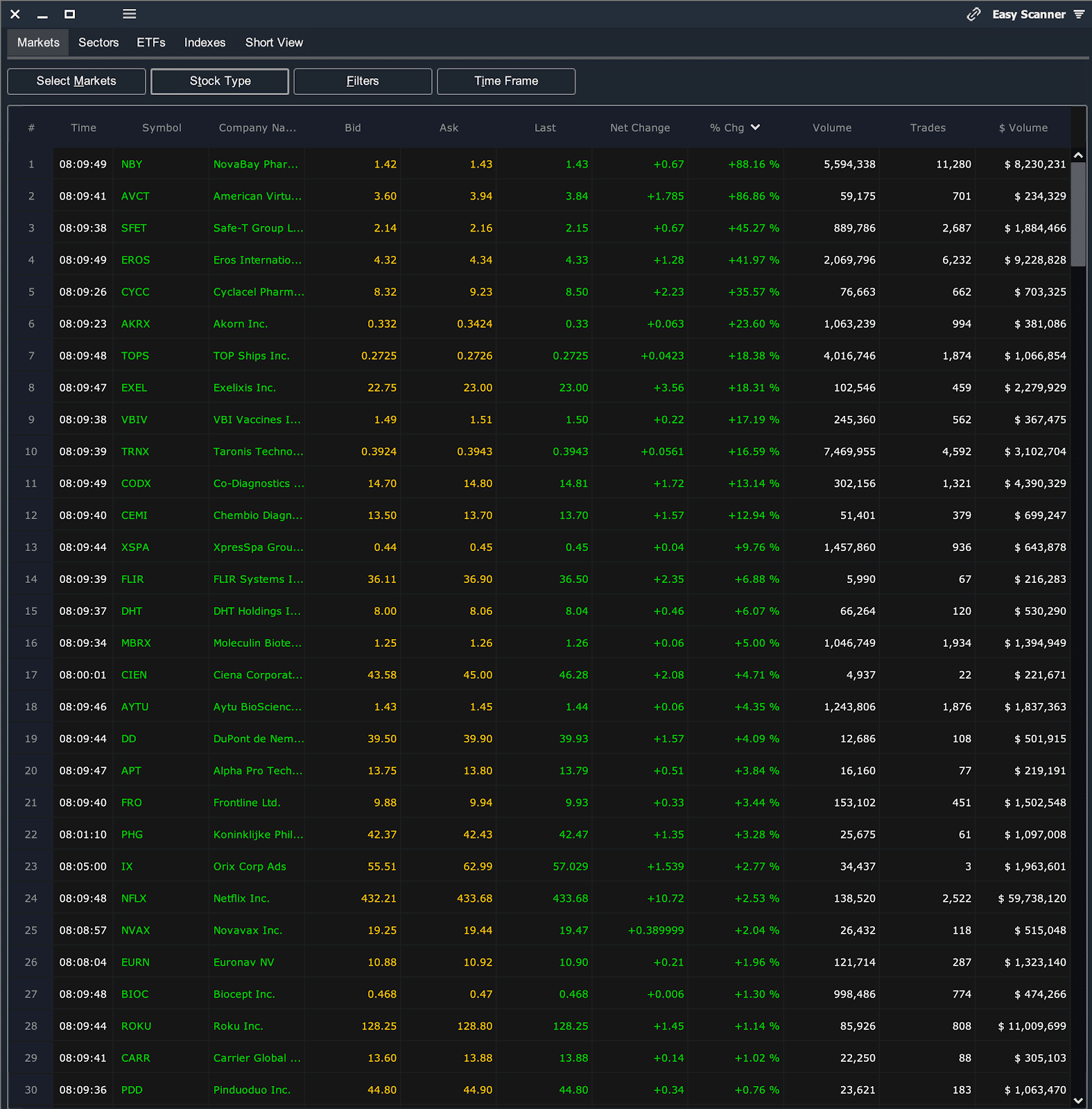

Basically, I pull up my scanner and look for my bread-and-butter setups. That way, I’m able to identify momentum stocks poised to move.

Today, I want to draw the curtain so you can get an inside look at my process and strategies.

My Process To Hunt Down Momentum Stocks

On Monday mornings, I’m up bright and early scanning for stocks and checking on any positions I’ve held over the weekend.

I like to check on the macros to see what’s going on with the overall market and piece together the puzzle. But when it comes to uncovering potential plays — I have special filters in place.

Let’s face it, there’s no way I can look through all the stocks moving… especially this week when traders will try to get their ducks in a row and chase alpha to end the second quarter.

My routine is pretty simple in my opinion.

I pull up my scanner and look for what’s moving.

Source: Scanz Technologies

Ahead of the opening bell, I look for stocks with a dollar volume of at least $200,000. In other words, $200K worth of the stock must have exchanged hands before the opening bell to come up on my radar.

Thereafter, I’ll look at what’s gapping up to identify potential momentum stocks to trade.

This lets me know which momentum stocks are liquid, and once I’ve got a list of names… I look at the charts. If I see my favorite setups come up, I’ll put them on my watchlist.

Once the opening bell rolls around, I actually change my filter.

Instead of looking for a dollar volume of at least $200K, I’ll look for stocks with a dollar volume of at least $2M.

You see, after the opening bell, traders are in full force… and if I leave my filter for stocks with just $200K, there will be so many stocks and those on the top of the list actually might not be liquid enough for me to trade.

In addition to looking for stocks to trade, I’m also managing any positions I may have on. For example, last Tuesday (Monday was a trading holiday), I was looking for stocks after the opening bell… and peeling off positions.

Tomorrow is the start of a new month and I’ll be ready to pounce on any momentum stocks I see that exhibit my bread-and-butter setups.

Now, if you want to learn how I’m able to uncover momentum stocks poised to run on a part-time schedule, click here to watch my trading workshop.

Jason Bond Monday Movers – How I Uncover Stocks Set To Pop?

Man, was it a wild morning session… I’m starting to get a little bearish and I think a pullback may be in the cards.

However, that doesn’t mean I’m not looking for stocks that could potentially gap up.

I know what you’re thinking… “Jason, how can you possibly buy stocks if you think a pullback may be in the cards?”

Well, with momentum stocks, they don’t necessarily move with the overall market.

You see, these stocks tend to move to the beat of their own drum… take HEXO and GRPN for example.

These trades were part of my Monday Movers watchlist and I was able to lock in nearly $4K on these two trades… coming off the long weekend.

Now, I want to show you how I’m able to spot these opportunities with my scalable patterns and set myself up for success.

How I Uncover Stocks Poised To Gap Up

When it comes to momentum stocks, I believe chart patterns and pairing them with catalysts can be beneficial for me.

You see, I’ve actually discovered there are patterns out there that have worked for me… and if I’m able to pair it with a catalyst… then I put myself in a position to profit.

To show you what I mean by that, I think it’ll be helpful to see how one of my chart patterns works in action.

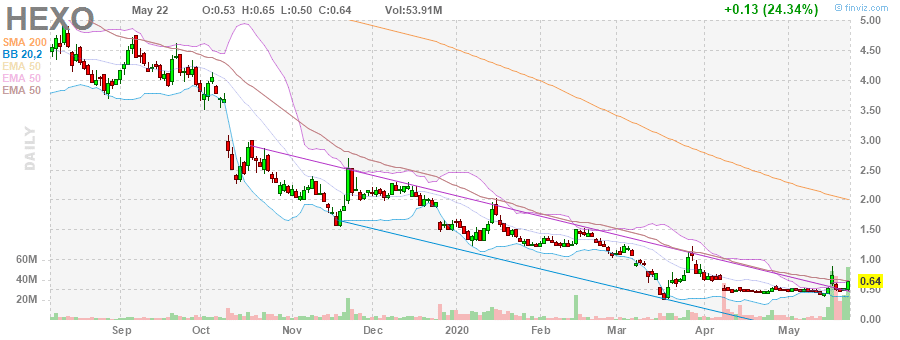

For example, HEXO is a cannabis stock… and the sector has been hot recently. So I figured it could catch a pop.

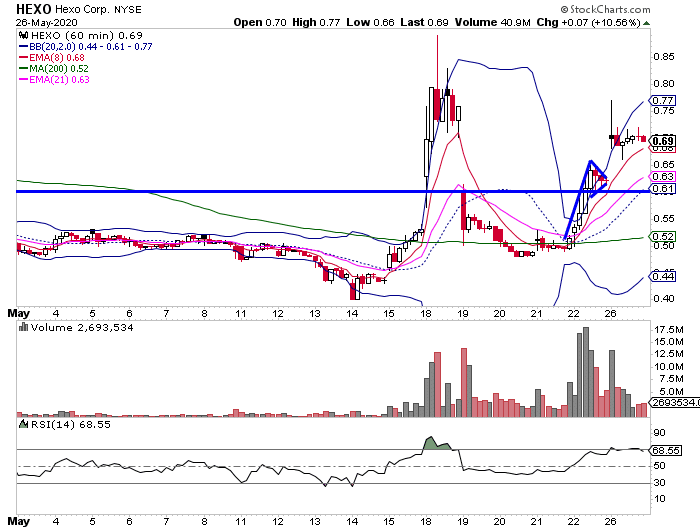

Here’s what I sent to Monday Movers subscribers in the watchlist last week, on Friday at 1:33 PM ET.

HEXO is more of a risky play because it’s already up 20%+ on the day but the pattern has range to the $.80’s and maybe even $1. Offering behind and a sector that’s catching pops, I’m interested in entry around $.58 with a stop loss below $.54 and a goal or 20%+ next week, assuming I take a position. Currently at $.63 I’m not looking to chase but enter on a dip, should one present itself.

Source: Finviz

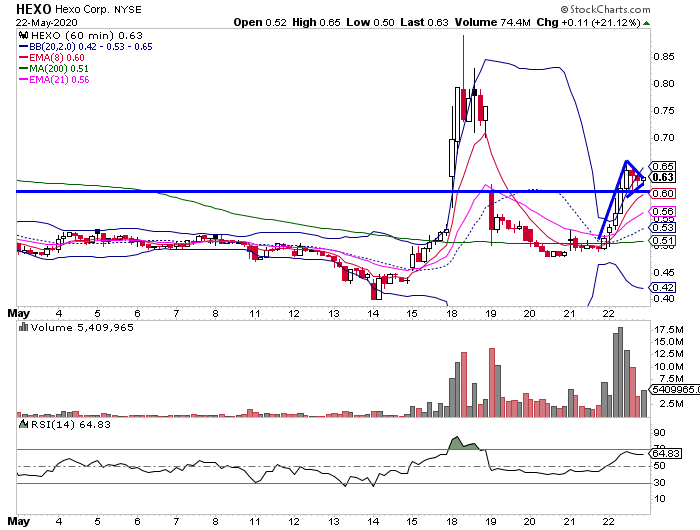

Now, here’s a look at the hourly chart in HEXO.

Chart Courtesy of StockCharts

If you look at the chart on Friday, it was actually getting into the gap… and forming a bull flag pattern. This let me know that HEXO could break out and potentially reach the $1 level.

Not only that, but there is a looming catalyst with cannabis companies potentially being able to have access to credit lines. It’s one way policymakers are trying to prevent the spread of coronavirus in cash businesses.

With a looming catalyst and a bullish chart pattern… I just had to come up with a trading plan and execute.

Now, here was my plan…

I’m interested in entry around $.58 with a stop loss below $.54 and a goal or 20%+ next week, assuming I take a position. Currently at $.63 I’m not looking to chase but enter on a dip, should one present itself.

Of course, I actually wasn’t able to get in near my entry… but I had a high conviction, and I didn’t want to miss out on the potential gap up.

So I actually picked up shares at $0.6177… and planned to hold it over the long weekend.

Well, HEXO actually gapped up and hit a high of $0.77 and completely filled the gap!

Chart Courtesy of StockCharts

I used that strength to take profits…

With momentum stocks, I believe I’m able to risk manage and efficiently make money… and go to bed knowing I’m in a position to profit.

Now, if you want to learn how I’m able to spot stocks that are poised to move… then watch this short training clip here.

Jason Bond Monday Movers – How I Set Myself Up For Success On Mondays?

If you didn’t catch the large pop in stocks… don’t beat yourself up because I believe there will be more momentum trading opportunities out there to hunt down.

This morning, I was able to take profits in Gogo Inc. (GOGO) — a momentum stock that I spotted and let my subscribers know about in my watchlist on Friday — after it gapped up.

Today, I want to show you my “weekend strategy” and provide an inside look at how I’m able to find stocks poised to gap up on Mondays… ahead of time.

How I Spotted The Move In GOGO Ahead Of Time

When it comes to uncovering stocks poised to gap up on Monday mornings… I like to keep things simple. I stick to my bread-and-butter setups and look for areas of value.

My goal is to get in on Friday and take profits come Monday… that way I still put my money to work, even when the market is closed.

Now, I believe it’s helpful if I use an example of how I use my “weekend strategy” to show you how it works.

So here’s what I sent out to Monday Movers subscribers on Friday.

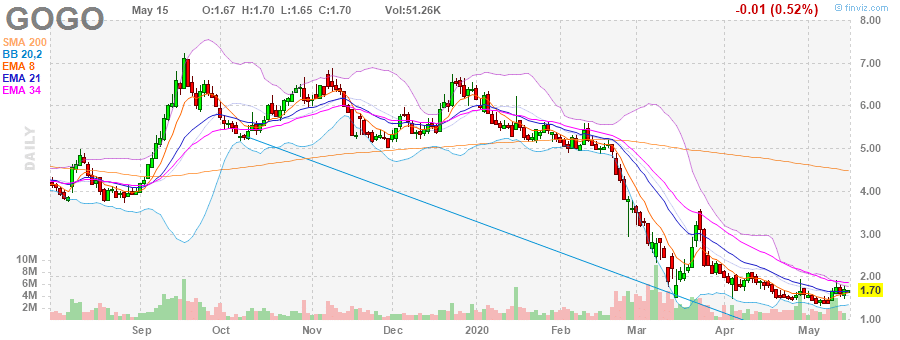

GOGO is the next stock I’m looking to swing. I like this base it’s been developing around $1.60 so that’s where I’m looking to buy above. I think it’s likely the $1.60’s offered today, assuming the market stays red, so that’s where I’ll look for 10,000 shares.

Swing into next week for me and only buying 1/2 size through the weekend. It’s clearly in a bearish trend but what I like is the 8 EMA is turning up toward the 21 EMA and the last time it did that shares went from $1.54 – $3.58 in just 7 trading sessions back in March. Assuming the $1.60 area holds I think a move above $2 is likely.

Buy zone $1.50-$1.60’s. Sizing 1/2 Friday. Goal $2’s. Stop 8 EMA $1.62 tight.

Source: Finviz

If you look at the alert I sent above, you’ll notice I was referencing a key pattern I noticed.

Let me show you a clearer view of the chart in GOGO.

If you look at the chart above, you’ll notice an encircled area. Basically, I noticed the orange line (the 8-day exponential moving average) was crossing above the 21-day exponential moving average (EMA).

To me, that was a signal GOGO could catch a pop and run higher.

You see, it’s known as a moving average crossover… and from my experience, just those two lines crossing could be powerful.

Based on that chart pattern, I was able to devise a concise trade plan… and all I had to do was execute.

Buy zone $1.50-$1.60’s. Sizing 1/2 Friday. Goal $2’s. Stop 8 EMA.

My buy zone was between the $1.50 – $1.60 range…

My goal was $2 in profits…

The stop would be just below the 8-day EMA.

Now, I did fumble on the trade a little bit because I was getting my advance notice alert out to subscribers. Basically, I wanted them to hear about the trade BEFORE I got in.

My entry was actually $1.68 on Friday… and on Monday morning, I took profits at $1.94!

Not quite near my target, but I’m not complaining about a nice $2,600 profit from a weekend hold.

I believe there will be more plays similar to the one in GOGO very soon, and if you want to learn more about my “weekend strategy” and how it can be easier than other trading strategies… then click here and watch this short training lesson.

Jason Bond Monday Movers Webinar

This 15-Minute Training Teaches You How You Could Profit From Weekend Trading.

Join Jason Bond and learn:

- Access this simple weekend trading strategy

- The fundamentals of weekend trades.

- Methods to spot stocks primed to gap up over the weekend

- How Jason scales by capitalizing on Monday news releases

- FREE instant access to Jason’s training ebooks

At the end of this training, you’ll get access to TWO of Jason’s training E-Books: Swing For The Fences & The Penny Stock Power Playbook — FREE!

Watch this Jason Bond Monday Movers FREE WEBINAR and GET THE BEST PRICE EVER!!!