Luke Lango will discuss his Daily 10X Stock Report service in-depth at his 10X Anomaly Summit. So make sure you’ve reserved your seat. It also comes with Luke Lango’s latest research report, 3 Cheap Stocks to Buy Under $10, which is absolutely free with your reservation.

Get Luke Lango’s Daily 10X Stock Report – Best Offer + Bonuses

Contents

- 1 Luke Lango 10X Anomaly Summit Details

- 2 What Is Luke Lango’s Project 10X – Daily 10X Stock Report Review?

- 3 Daily 10X Stock Report Review – How It Works?

- 4 Daily 10X Stock Report Review: Past Performance

- 5 Daily 10X Stock Report Review – Is It Worth It?

- 6 Daily 10X Stock Report Review – Project 10X Revealed

Luke Lango 10X Anomaly Summit Details

If you haven’t signed up for Luke Lango’s special event on Wednesday, June 9, at 4 p.m. Eastern, please do!

That’s when he’s hosting the 10X Anomaly Summit, where Luke will be introducing you to his ultra-exclusive research experiment, known as Project 10X.

You can click here to sign up.

What Is Luke Lango’s Project 10X – Daily 10X Stock Report Review?

When I first set out with a small research group to create what would become Project 10X – our experimental service focused on hypergrowth investing – the stock market was in a very different place.

The macro-investing environment of 2021 has shifted dramatically in the year or so since we started this project.

Whereas 2020 was a year of low growth and low rates, 2021 has been defined by rising rates and accelerating economic growth.

As a direct consequence, our growth-stock hot streak cooled off as yields shot up about 30 basis points in mere weeks, causing investors to sell off their tech and growth assets.

Yields shot higher because the U.S. economic outlook rapidly improved. Everyone was getting vaccinated. Restaurants and retail shops were reopening. People were booking flights. Consumer confidence was rebounding. Retail sales were surging. Manufacturing activity was picking up.

The U.S. economic recovery was gaining significant momentum, which increased inflation and growth expectations. That pushed yields higher and weighed on tech stocks.

Inflation is the death of growth stocks, since it simultaneously weighs on valuations, dilutes the present value of future profits, makes growth more expensive to fund, and crimps profit margins.

A rising-rate, high-growth macro environment means emerging growth wasn’t the only game in town in 2021…

This all comes down to the cost of equity.

The cost of equity is a major factor in whether investors are buying value stocks or whether they’re buying growth stocks.

And over the past 10 years, what they’ve bought became particularly one-sided.

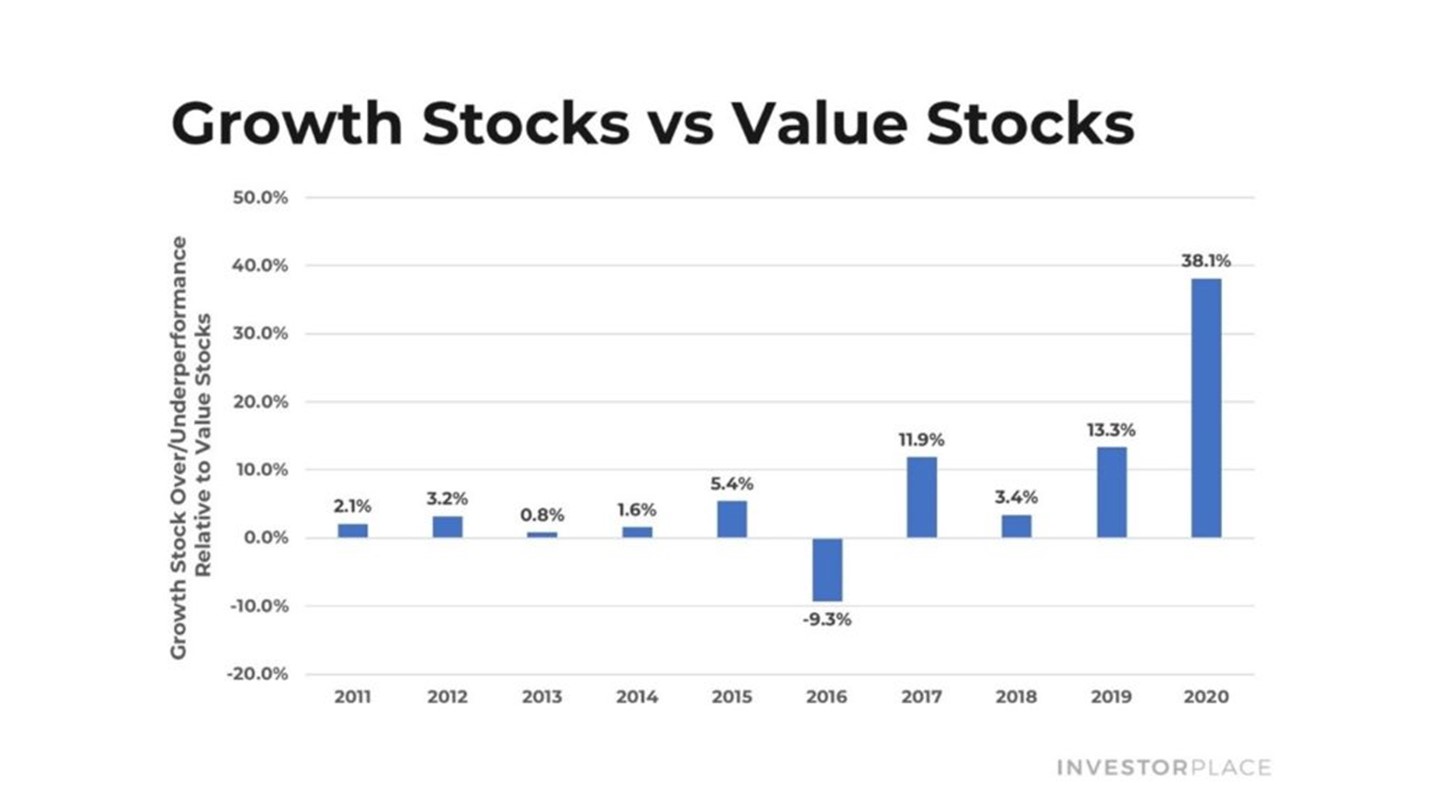

Which is to say that growth has absolutely trounced value stocks for the past decade.

From 2011 to 2020, the Vanguard Growth ETF rose by 311%. That’s more than double the 126% gain in the Vanguard Value ETF over the same stretch…

Most importantly, growth stocks outperformed value stocks in every single year over that stretch, except for one: 2016.

But as you can see in the chart below, growth stocks more than made up for it the following year, when growth outperformed value by a then-record 11.9%.

All of this outperformance comes down to one thing – the cost of equity.

Daily 10X Stock Report Review – How It Works?

The cost of equity is the single most important metric for the sort of hypergrowth investments we pursue in Project 10X. It essentially means “the required rate of return on an investment in equity.” Or, in plain language, the annual rate of return you’d need to invest (and remain invested) in stocks.

Not to go deep into the Finance 101 weeds here, but the formula is calculated according to the Capital Asset Pricing Model (CAPM), which is as follows: the cost of equity equals the risk-free rate plus the equity-risk premium.

The “risk-free rate” is a proxy for returns in a risk-free instrument such as a Treasury note, and the “equity-risk premium” is the additional return required for taking on the risk of stock investing.

The cost of equity drives stock prices. When it’s low, the future carries more value than the present. Which means that growth stocks outperform, as they derive most of their value from future expectations. When it’s high, however, the present carries more value than the future, meaning that value stocks tend to outperform for inverse reasons.

It’s heavily correlated to interest rates and economic health, which have changed dramatically in the past year.

However, folks like you and I know that technology is the future of everything.

We know that electric, self-driving vehicles will become ubiquitous over the next few decades.

We know that solar, wind, and hydrogen will power the world by 2040.

We know offices, gyms, casinos, malls, and more are increasingly become virtualized.

That’s why smart investors like you and me want to buy growth stocks no matter what… the sort of stocks we pursue in Project 10X. These stocks represent the future, and the way to score life-changing returns in the stock market is by investing in the future. So, while value may be shining right now, folks who buy tech stocks today will be incredibly happy in 3, 5, 10-plus years.

And so, the question I’ve been the asked the most over the past few months isn’t “Should I buy the dip in tech stocks,” but rather “When should I buy the dip in the tech stocks?”

The answer? Right now.

We’ve been tested throughout 2021, but there’s a light at the end of the tunnel. One that we’re already beginning to see as economic data begins rolling in and confirming our thesis…

At this moment, more than perhaps any other time in history, we’re on the cusp of a critical inflection point that could hand out 1,000% gains like clockwork.

This isn’t guesswork – my team and I have done, and continue to do, the hard research to test our market hypotheses.

What we’ve found is that a massive “wall of cash” is headed into growth stocks. And we’ve identified three reasons why:

- The economic data is slowing, causing 10-year Treasury yields to fall and growth to become less diverse, leading to money flowing back into tech stocks.

- The cryptocurrency bubble has stabilized, and the speculative money that flowed into the crypto market over the past few months will likely make its way back into growth stocks.

- Valuations on tech stocks have corrected much lower and are now in line with historically normal standards.

Let’s break this down…

Get Luke Lango’s Daily 10X Stock Report – Best Offer + Bonuses

Daily 10X Stock Report Review: Past Performance

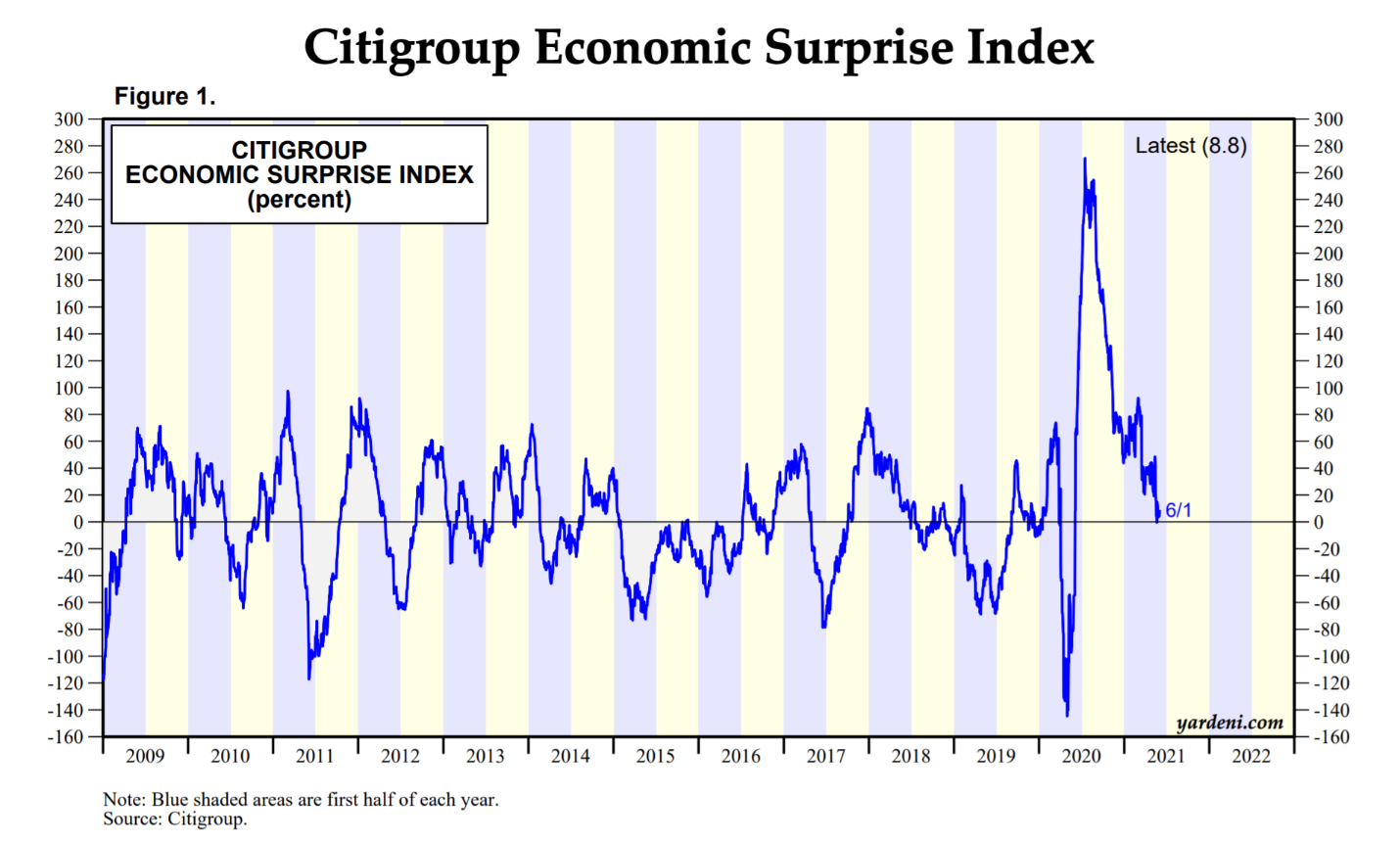

The economic data over the past month – from jobs reports and to jobless claims to consumer confidence and retail sales – has come in consistently below expectations, and it is showing a clear and undeniable slowing trajectory from its April highs.

Just look at Citi’s Economic Surprise Index, which is a broad-basket measure of how real economic data is performing relative to expectations. It’s been on a rapid decline over the past month, and now it barely hovers above zero.

What’s going on under the hood? Well, a broad economic reopening of the kind we saw in March and April only happens once in a lifetime – it’s a temporary phenomenon. Right now, consumers are exhausting their pent-up demand. We’ve already gone to restaurants, done our shopping, and bought new cars. As a result, demand is moderating to more normal levels.

Meanwhile, the world is struggling with supply-chain issues thanks to Covid-related restrictions. But those bottlenecks are quickly improving.

For instance, while both the Markit Manufacturing PMI and ISM Manufacturing Index for May came in above expectations, further examination shows how this actually supports our outlook on small-cap growth.

The better-than-expected figures are driven mostly by supply-chain constraints. Basically, factories are struggling to keep up with demand due to limited production capacity.

Just look at the Renesas computer chip factory in Japan, one of the most important and largest auto chip production facilities in the world. It burned down in March and stopped production, but it is already back to 88% capacity and plans to be back to 100% later this month.

Going forward, then, demand in the economy will moderate, supply will increase, and the net result will be a low-growth, low-inflation environment – much like the one we’ve been immersed in for the entire 21st century.

In that environment, yields will remain lower for longer, tech/growth stocks will outperform, and cyclical/value stocks will underperform.

This reversal back to “normal times” is exactly what’s happening right now – and we’re on the right side of the trade this time.

Get Luke Lango’s Daily 10X Stock Report – Best Offer + Bonuses

Daily 10X Stock Report Review – Is It Worth It?

Secondly, we’re in the midst of a correction in big-name cryptocurrencies, wherein Bitcoin is collapsing, and speculative money will move back into growth stocks.

The same folks who buy bonds would buy stocks in the Dow Jones. They’re low-risk, near-term-return driven investors. It should be no surprise, then, that as bonds sold off over the past few months, the Dow Jones has rallied. Money left bonds and flew into the Dow.

Extrapolate this to Bitcoin and growth stocks.

The same folks who buy cryptocurrencies would buy growth stocks. They’re higher-risk, long-term-return driven investors. It should be no surprise, then, that as growth stocks have struggled over the past few months, cryptocurrencies have surged higher. Money was fleeing growth stocks and running into cryptocurrencies.

That dynamic appears to be reversing course now.

Over the past month, cryptocurrencies have plunged, led by a whopping 35% decline in Bitcoin, on a variety of concerns ranging from valuation to environmental friendliness, to government restrictions.

Guess what has happened during this crypto decline? Growth stocks have outperformed.

As cryptos have dropped over the past few weeks, growth stocks have shaken out of their slump and powered higher.

We suspect this trend will hold for the time being.

On the final point, valuations in the technology sector look much more normal now and provide a solid base for big upside in tech stocks in the coming months.

Previously, tech stocks were richly valued. Today? Not so much.

With economic growth slowing, yields flattening out, and cryptocurrency hype dying down, these “normal” valuations provide a solid base for tech stocks to turn into the market’s biggest winners once again.

All in all, at Project 10X, color us bullish.

The past few months have been rough for early-stage growth investors. The next few months will be a lot better – and this rebound will begin an enormous multi-ear run higher in early-stage tech stocks as these companies redefine the world in the 2020s.

Get Luke Lango’s Daily 10X Stock Report – Best Offer + Bonuses

Daily 10X Stock Report Review – Project 10X Revealed

I’ll explore all this and a lot more in great detail at my 10X Anomaly Summit on Wednesday, June 9, at 4 p.m. Eastern. Once you’ve signed up, make sure to mark your calendars, as you absolutely do not want to be late for this.

Tomorrow, I want to go over one of my favorite methods – Project 10X – for outperforming the market.

With this strategy, investors discover that it’s not only possible to beat the market, but also to beat the market consistently.