How would you like to own an ETF that favors you instead of “the house?”

VIX Trader can tell you what ETF is set up to work in your favor and how to trade Volatility ETFs, a new and powerful category of exchange traded funds designed to seek profits in today’s volatile markets.

Here’s a quick summary of what you get with VIX Trader:

- A practical method for trading a widely watched and traded index, a new asset class that can be used for directional trading, diversification, portfolio hedging or volatility options trading.

- A complete understanding of the one VIX ETF that allows investors and traders to effectively “buy low and sell high” more than 75% of the time.

- A complete introduction to the S&P 500 VIX Index, also known as “the fear index,” how it works and how VIX ETNs can offer a way to trade volatility within a traditional brokerage account or even IRA or 401k.

- A complete trading system designed to compete effectively with the institutions, computer based trading programs and algorithms that have introduced so much volatility into today’s markets.

- Ongoing education and training that lets you “look over our shoulders” and learn how to trade these complex and exciting markets. You’ll never be alone.

- An in depth option trading program.

Would you like to learn more?

==> Register for the next VIX Trader Webinar Here

VIX Trader Shows You The Best VIX ETNs and How To Trade Them

- VXX: iPath VIX Short Term Futures ETN

- XIV: VelocityShares Daily Inverse Short Term Futures ETN VIX Trader will show how and when to move from long to short positions or cash, depending upon market conditions.

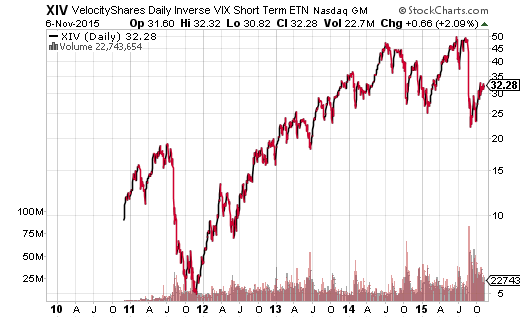

VIX Trader will show you how to trade VIX ETFs like XIV, VXX and UVXY. VIX Trader will teach you how to trade options on VIX ETFs which can further leverage potential profits. You’ll gain a complete understanding of the one VIX ETF that allows investors and traders to effectively “buy low and sell high” more than 75% of the time.XIV: VelocityShares Daily Inverse Short Term VIX

This ETF has dramatically outperformed the S&P 500. From its inception on December 1, 2010, to June 30, 2015, this ETF gained 307% while the S&P 500 gained 69.1% (prices from StockCharts.com, dividends, costs, taxes not included)

| Year | VIX ETF | SPX |

| 2011 | -47.2% | 0% |

| 2012 | +130.2% | +13.3% |

| 2013 | +88.8% | +29.6% |

| 2014 | +0.24% | +11.5% |

| Jan-June 30, 2015 | +25.9% | +0.20% |

(for educational purposes only)

The chart above shows what buy and hold looks like compared to the S&P 500. But XIV isn’t really built for buy and hold. Check out the chart below and see the significant draw downs along with significant gains.

But do you see some trading opportunities in the chart above?

VIX Trader will teach you how to trade XIV and give you a chance to profit from what could be the best ETF you’ll ever own.

But when volatility spikes, VXX makes all the big moves and VIX Trader will show you how to trade both of these fast moving ETFs.

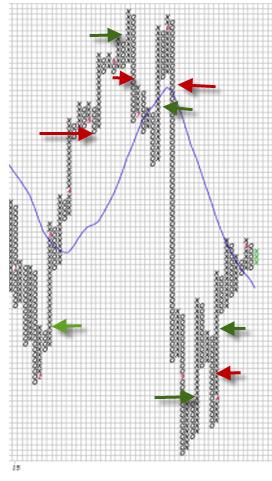

VIX Trader point and figure charting methodology gives you:

- Entry points

- Exit points

- Clear Supply and demand information

(for educational purposes only)

Point and figure charting has been around since the days of Charles Dow and “takes out the noise” to give you a clear, easy to follow picture of market action and supply and demand. But there are some tricks to it and you’ll learn all of these in VIX Trader.

The chart above is a point and figure chart of XIV for 2015. This chart is the basis for trading XIV and VXX and then its signals are confirmed with a momentum indicator (which you’ll also get) to make sure you’re only trading in the direction favored by short term directional momentum.

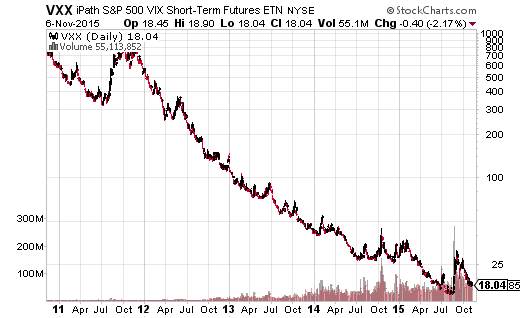

¨You’ll also learn how to trade VXX: S&P 500 Short Term Future ETN:

This is a wildly popular ETF, trading more than 75 million shares per day. The chart of VXX shows what a loser this ETN can be but also how sort term bursts of volatility can offer quick and large profits.

VIX Trader teaches you how to use the VXX ETN during periods of market volatility and how to use VXX bearish option spreads during periods of market calm so you can have the opportunity to seek option income even as VXX declines.

With VIX Trader, you’ll get 11 Trading Videos that give you everything you need to trade effectively:

- VIX ETNs

- Trading Basics

- Point and Figure Charting

- Trend confirmation

- Buy and Sell Rules

- Anticipation based trading

- Risk management

Plus ongoing education and training that lets you “look over our shoulders” and learn how to trade these complex and exciting markets:

Another important part of the package is our VIX ETN and Option Trading Alerts. (You can just follow these if you don’t have time to learn this system or don’t want to do it all yourself) or you can use them to “follow along” with our trades as you pursue your goal of becoming a successful volatility trader.

Members’ special features also include:

- Weekly webinars

- One on one coaching

- Daily market updates

- Private members’ page

- Articles and educational resources

The VIX Trader Special Sale ends tomorrow night at Midnight so you have until then to take advantage of this very special pricing on this very special program.

VIX is a new asset class that you can use to seek directional trades, hedge your portfolio, manage risk or seek rapid fire options gains.

Would you like to learn more?