Nothing is more frustrating than getting the trade right…But the options wrong…

It almost feels like someone is personally trying to screw you out of profits.

I know that’s how I used to feel early on in my options trading career…

But then I realized something…

Options and stocks can move totally different from each other…

And it’s not some sort of black magic either.

Forgive me, but today I’m going to get somewhat technical with you.

However, this is a critical lesson if you want to try to make money as an options buyer.

And it’s all centered around an “option Greek” called Delta.

Traders use “option greeks” to measure the different dimensions of risk in an options position.

Delta tells us how much we can expect the options price to change relative to a $1 move in the stock price.

The lower the Delta (out-the-money options) the less sensitive it is to moves in the underlying stock.

The higher the Delta (in-the-money options) the more sensitive it is to moves in the underlying stock.

Now, most traders like to play cheap out-of-the-money options in hopes of scoring a big win.

What they don’t realize is how often these lose.

It’s like buying lottery tickets at the store – you’re just throwing away money.

Instead, I buy in-the-money options. Yes, they’re more expensive, but they don’t lose as much value over time.

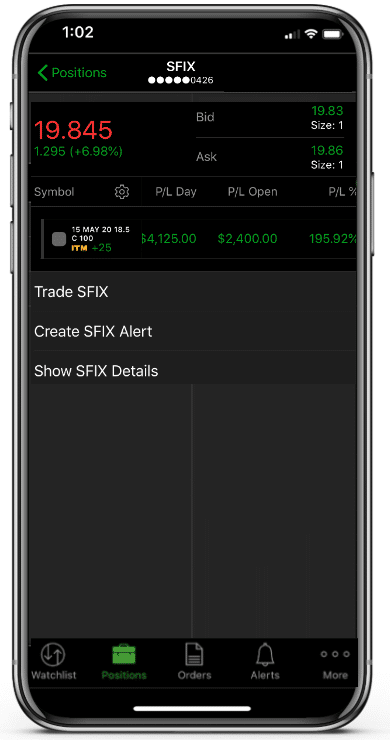

That’s how I managed to wrangle nearly 200% on this Weekly Money Multiplier trade in Stitch Fix.

Not a bad profit for a few days worth of work!

I know, I know…you want to know what I’m talking about.

Don’t worry, papa Bear is here to help.

I’m going to explain not just why this occurs but how to use it to your advantage.

Delta basics

While we all know about the ‘deltas’ from college, this delta is a bit different.

Delta in options trading refers to the amount an option price will change for every +$1 movement in the underlying stock. For call options this ranges from 0 to 1 and for put options it ranges from -1 to 0.

Options that are at-the-money (where the current price and the strike price are the same) will have a delta of 0.5 for calls and -0.5 for puts.

You can also think of it as the number of shares that you control multiplied by 100. If my call option has a 0.30 delta, I control 30 shares of stock.

When an option is at-the-money, it has the most extrinsic value possible and no intrinsic value.

Intrinsic value is the amount of money an option has at expiration. For a call option the stock’s price must be above the strike price, and below it for a put option.

The intrinsic value is the difference between the stock’s price and the strike price. Everything left over is the extrinsic value.

Extrinsic value is what decays over time. This is what works against you when you buy calls or puts.

So, how does delta relate to this?

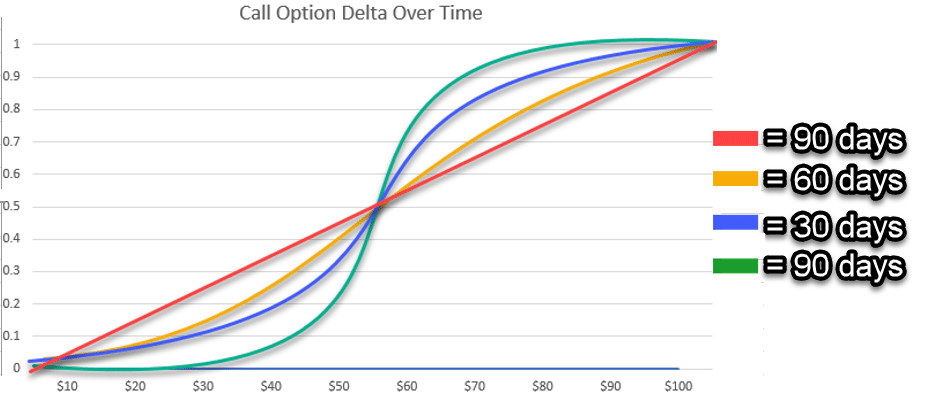

Well, delta decreases the further out-of-the-money you go. If you were trading a call option it would look like this on a stock that is $55.

You see, at first, the curve is pretty flat. But, the closer you get to expiration, the more it starts to look like an ‘S’.

So, when I buy options that are in-the-money, I get a higher delta that gets higher over time. That means the option will move more tightly with the shares.

For me, this is a good thing because I’m lowering the amount of money I need to risk for the trade, but still getting to pick up most of the price movements.

Trade example

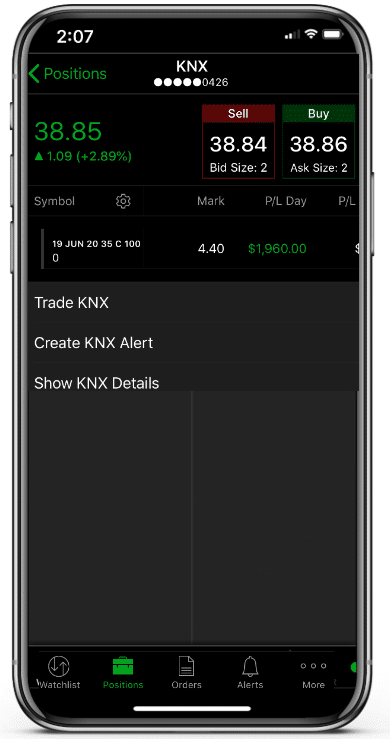

Here’s how I recently applied it to Knight Transportation (KNX).

I found a TPS setup on the 190-minute chart that looked rather appealing.

KNX 190-Minute Chart

Now, with this TPS setup, I had the uptrend, consolidation pattern, and a squeeze all waiting for me. All I had to do was select the right options contract.

For this trade, I chose the June 20th $35 call options. That put me at around a 0.6 delta.

These options cost me a few hundred dollars per contract vs out-of-the-money ones that might have only been a hundred dollars.

However, I didn’t need to worry as much about time decay on these options. That gave me peace of mind since I needed to give it a few days to work out.

In the end, I scored a nice victory making almost $2,000 in about a week.

Now, if this trade had taken longer, let’s say another week, I would have made close to the same profit with these options.

However, if I had used out-of-the-money options, my profit could have been chopped by nearly 25% just because they had no intrinsic value!

So, while I accept options that cost more, I set myself up for a better chance at success.

Putting it all together

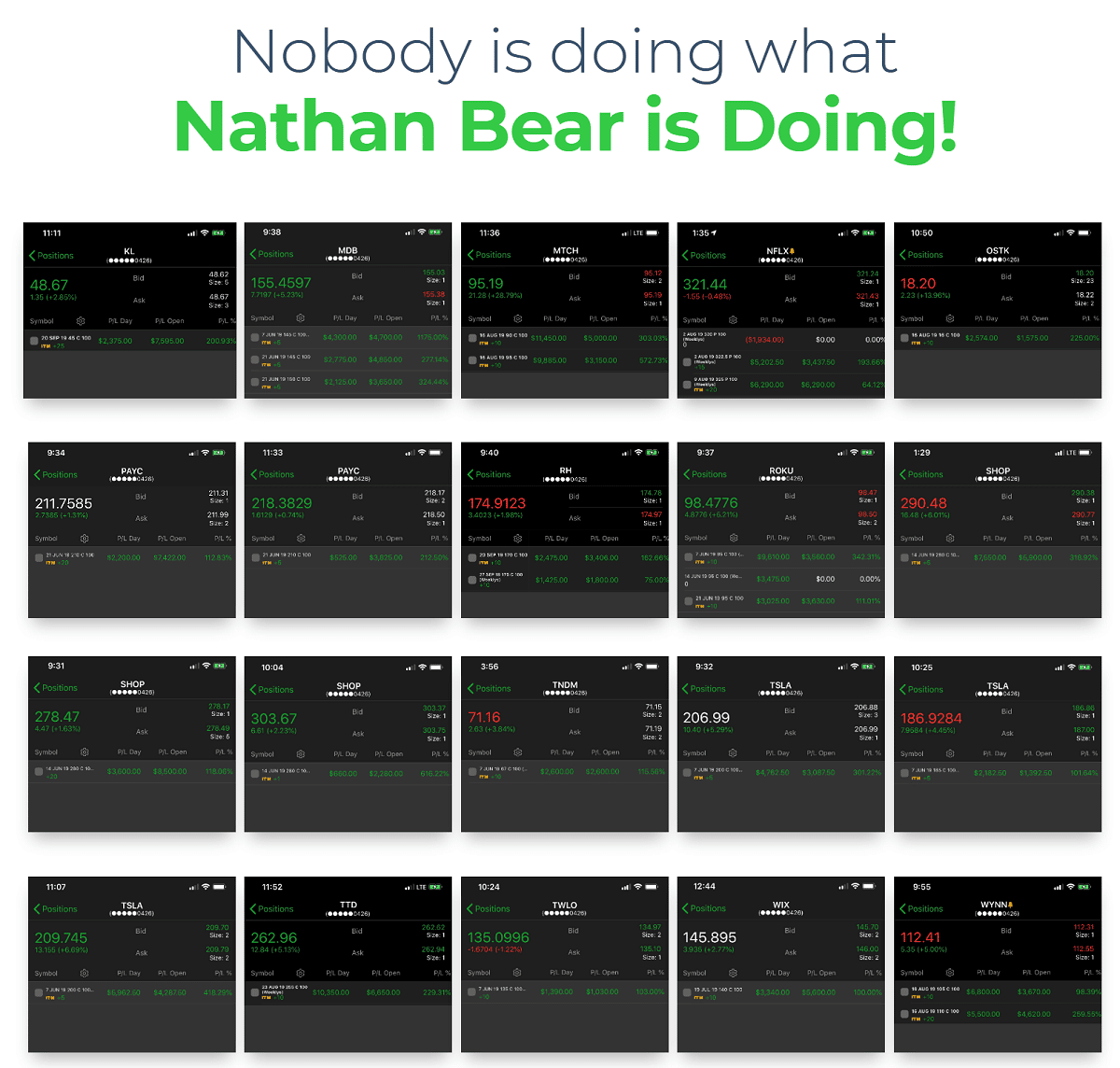

Recently, I sat down with Raging Bull cofounders Jeff Bishop and Jason Bond to discuss my journey from a habitually losing trader to turning my $38,000 account into over $2,000,000 in just two years.

Not only do I discuss the techniques that I used to generate those returns, but specifically how I finally turned my trading around.

Click here to register for my webinar.

Source: Weeklymoneymultiplier.com | Original Link